Management of cases of maternity

Entering the variable maternity allowance (federal allowance)

Salary type 2040.00 Maternity allowance will be cumulated in the AHV/AVS-ALV/AC, KTG/IJM, Taxable salary and Gross total bases. No deduction for UVG/LAA-NBUV/AANP.

No negative adjustment via salary type 2050.00 as for other cases of sickness and accident benefits.

The purpose of entering the maternity allowance is to exempt this amount from UVG/LAA-NBUV/AANP contributions.

Special case for Geneva canton :

- case of maternity allowance not subject to KTG/IJM: type of salary 2040.10

- case of maternity allowance Geneva: type of salary 2040.20

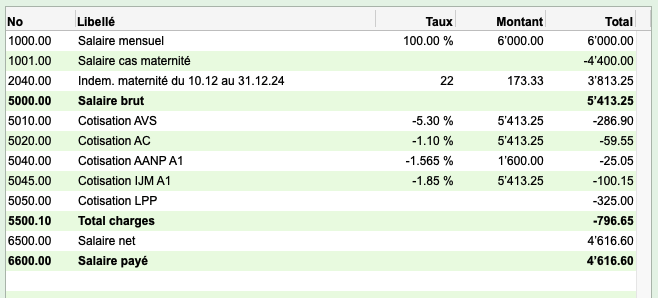

MONTHLY SALARY CASE: Payment of maternity allowance at 80% :

Indicate under salary type 2040.00 :

- under Rate: the number of days compensated

- under Amount: the daily amount confirmed par the AHV/AVS institution in their settlement.

You can also simply enter the total amount with a detailed description.

Monthly gross salary adjustment (if necessary)

Enter salary type 1001.00 as a variable, in negative to adjust all or part* of the monthly salary, with an explanatory label such as "Maternity salary".

*The maternity allowance is not necessarily 80% of the monthly salary. Some employees may have variable salary elements to take into account, so refer to the conditions of your insurance contract for the adjustment of the gross salary.

You will then have a separate line indicating this adjustment, and the gross monthly salary will remain the same, in accordance with his employment contract.

HOURLY SALARY CASE: Payment of maternity allowance at 80% :

Indicate under salary type 2040.00 :

- under Rate: the number of days compensated

- under Amount: the daily amount confirmed par the AHV/AVS institution in their settlement.

You can also simply enter the total amount with a detailed description.

Hourly gross salary adjustment (if necessary)

An hourly salary (salary type 1005.00) may or may not include hours worked during the month, in addition to the maternity allowance paid for the full or partial month.

If necessary, simply adjust the wording of salary type 2040.00 to show the details of the period.

In most cases, the daily benefits paid by insurance companies already include the 13th, holiday and vacation entitlements (please refer to the terms and conditions of your insurance contract for each case).

Français

Français Deutsch

Deutsch Italiano

Italiano