Sending a VAT statement over the web

Swiss companies subject to VAT are required to send the Federal Tax Administration a quarterly or half-yearly statement of VAT collected and paid.

This statement can be printed by Finance on an official form and sent by post or directly transmitted electronically.

Here's how to transmit electronically:

In the Accounts file (accessible via the Data menu), call up the Print command. Select the print format Swiss VAT form or Swiss VAT form (contractual), depending on your company's situation. Confirm with the Print button.

|

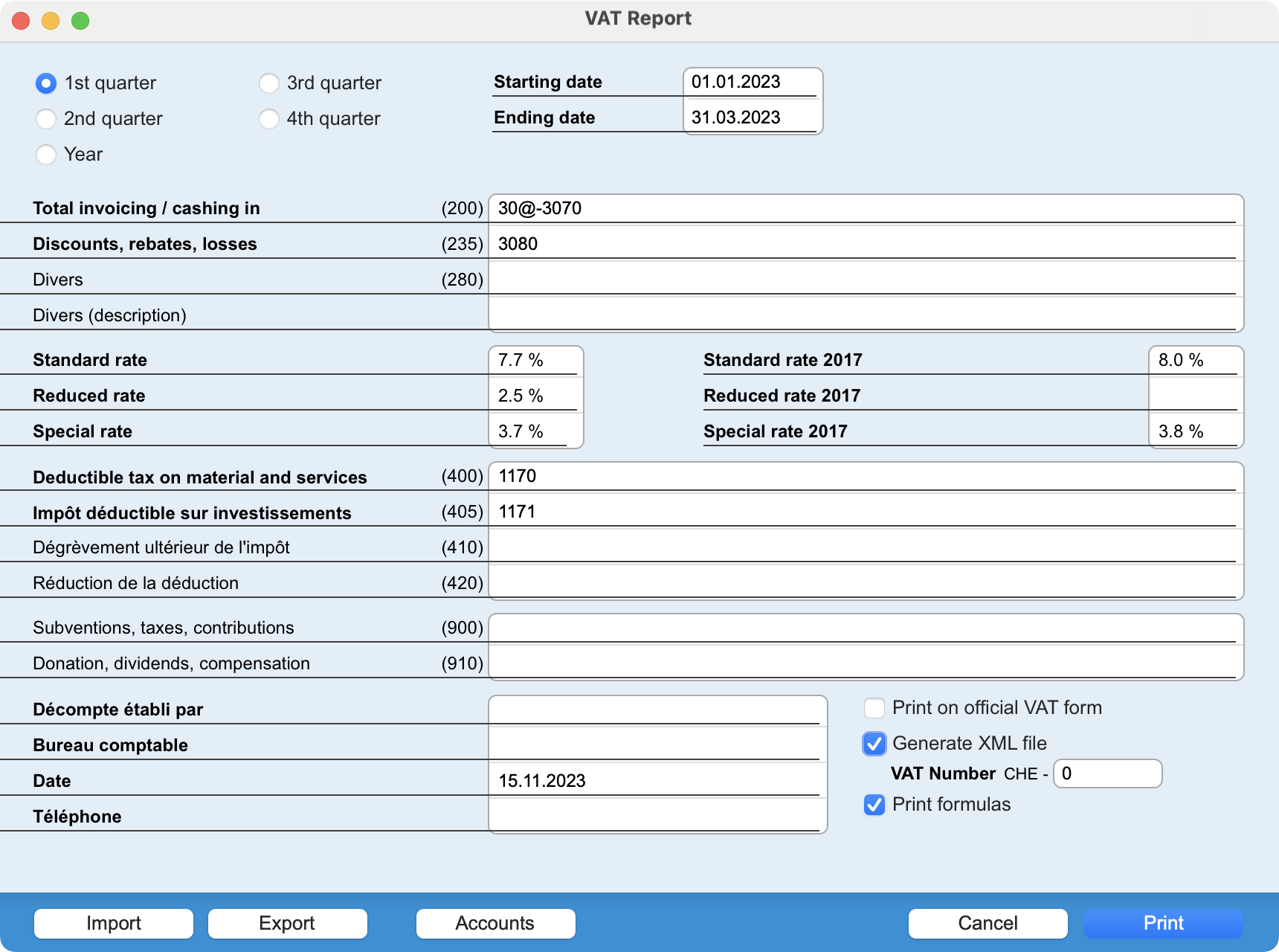

In the window that appears, select the quarter or half-year for the settlement, as well as the start and end dates. Define the accounts to be used for your settlement (detailed information can be found in the software manual). Check the Generate XML file box and enter your company's VAT number. Once all the fields have been filled in, click on the Print button to confirm the dialog. |

In addition to the standard print dialogs, a file save window lets you specify the disk location and name of the XML file to be generated.

Then connect to the https://eportal.admin.ch/start website to transmit the XML file.

Français

Français Deutsch

Deutsch Italiano

Italiano