Calculating VAT when entering a simple accounting entry

If you need to manage VAT, you must first define the usual rates in the VAT rates file. Then, when you enter an entry, you can refer to a VAT rate by filling in the VAT code field.

The presence of a VAT code in an entry line will trigger a VAT calculation, either when you request it, using the Calculate VAT command in the Entry menu, or automatically, when you validate the entry.

For certain operations, it may be necessary to define specific VAT codes to enable automatic printing of the VAT statement.

Simple entry

When you want to create a simple entry, consisting of just two lines (account and counterpart), the VAT calculation can be fully automatic. Let's take the example of a purchase account (No. 4040), in whose master record you would have entered Account No. 2000 as Counterpart and the value 5 as VAT Code. In the VAT rates file, this code would correspond to a rate of 8.1% inclusive, and would itself be associated with account No. 1170 ("Input tax on purchases of materials and services").

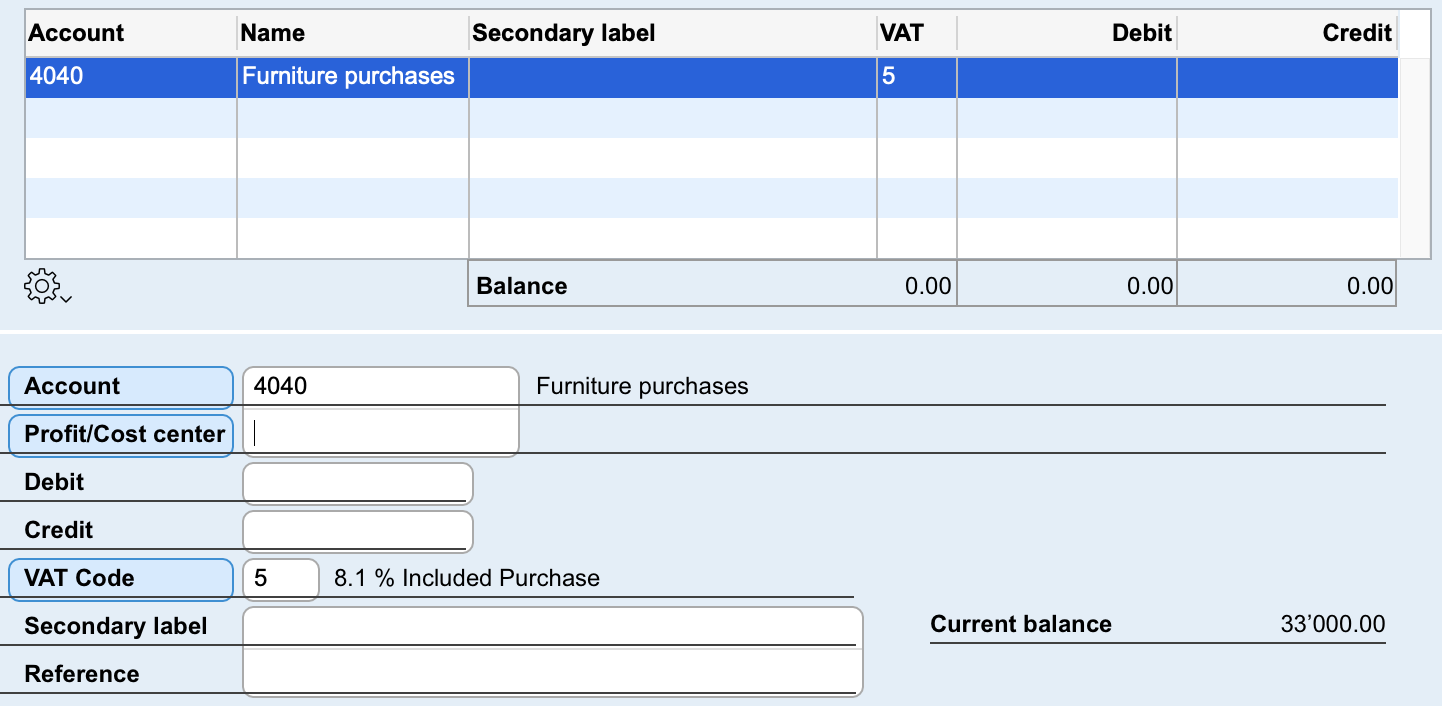

After entering 4040 in the Account no. field on the first line and pressing the Tab key, the account name is displayed, along with the VAT code assigned to it:

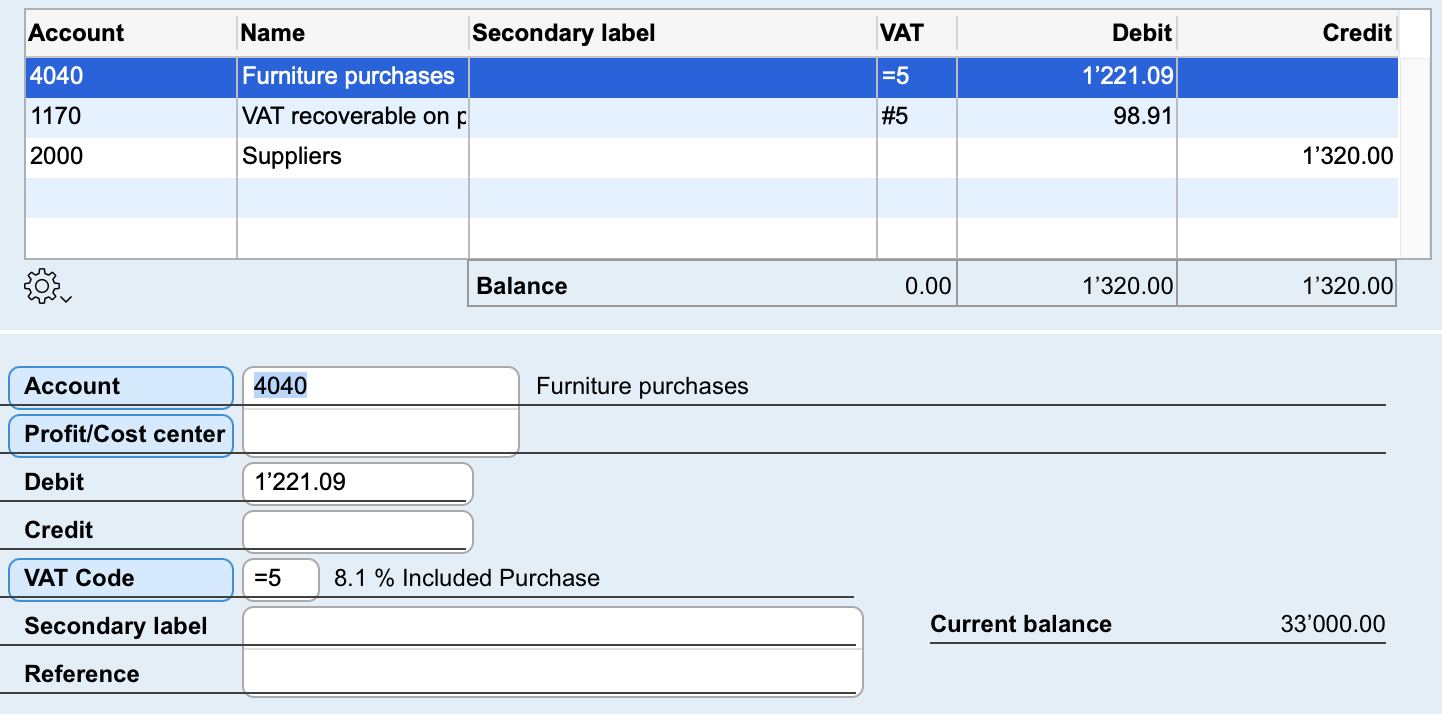

Then enter the value 1320 in the Debit field and press Tab. The counterpart appears automatically and an additional line is generated for VAT.

The VAT code of automatically calculated VAT lines is preceded by the # sign (pound sign).

The VAT code of automatically calculated VAT lines is preceded by the # sign (pound sign).

Also note that the amount of 1,320.00 initially entered on the purchase account is recalculated to extract the amount without VAT. In fact, code 5 here corresponds to VAT included in the amounts you enter.

The entry is now balanced, so all you have to do is validate it.

Français

Français Deutsch

Deutsch Italiano

Italiano