LSV Proposal (triggering the collection procedure)

The LSV direct debit system allows you to initiate payment to your debtors yourself.

This system requires the signature of a contract with your bank, as well as debit authorization from your customers. Please contact your bank for further information.

Once you have the data supplied by your bank, set up Business in Maintenance and in the address files of the customers concerned (in the Debtor tab, LSV Bank and LSV Account fields).

LSV Proposal

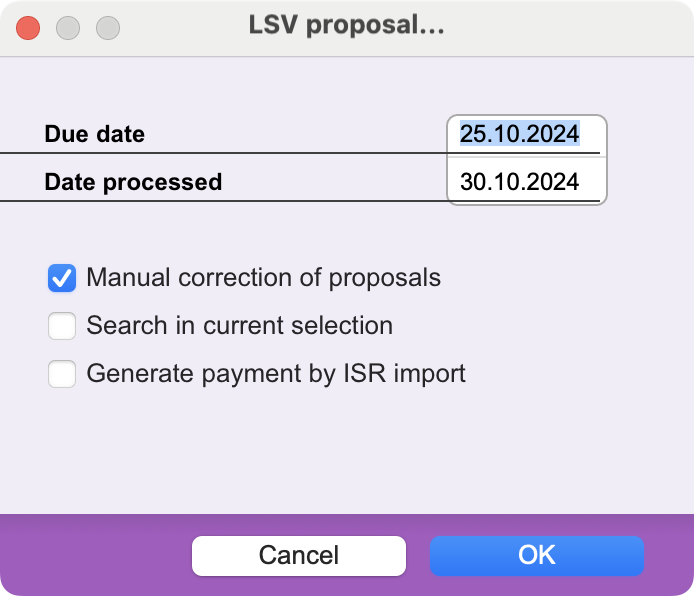

To initiate the collection procedure, call up the Action>LSV proposal command from the Debtor invoices file. A dialog box with various options appears:

Due date

This first criterion limits the selection of Invoices to those due on the date indicated. The current date is proposed by default.

Date processed

You must respect the deadline required by the bank's calculation center to set the processing date. This period is three or four working days after the date on which the data is sent.

A message is displayed by the program if the requested date is inconsistent or if LSV processing has already been carried out on this date. In this case, you must correct the date entered.

Manual correction of proposals

If you check this option, the Invoices to be processed are first presented to you in a list of proposals. The last column of this list shows the Payable Balance for each Invoice.

Double-click on any line to open Invoices in view mode. The manual selection buttons can be used in the usual way to select the records to be retained for further processing. By clicking on Cancel, you can interrupt the LSV collection process.

If you wish to sort the list of proposals, use the Sort command, available in the Action menu.

The Modify command, available in the Action menu or in the button bar, brings up the Invoice modification screen. At the bottom of the window, you can modify the amount to be cashed, in the LSV Amount field.

The default value is, of course, the Invoice Payable Balance, but you can decide to collect only part of this amount. In this case, the remaining balance remains due. If you wish to discount it, you can do so at a later date, using the normal payment entry method.

You can also enter a comment for the debtor in the Communication field. By default, the program inserts in this field the text you have entered in the Communication field of the LSV configuration window (e.g. “Invoice Nº 13098”). You can replace or add to this text; the maximum number of characters allowed is 105.

Once you have made the desired changes, click on the Generate button to continue the process.

Search in current selection

If this option is unchecked, the program scans the entire Invoices file and retains all open invoices in Swiss franc with the LSV box checked, which are due on the date you have specified.

However, if you wish, before selecting the LSV Proposal command, you can select the Invoices to be cashed yourself. If you select this option, the proposals will only concern the records you have chosen, provided they also meet the above criteria.

Generate payments by ISR import

Usually, exporting an invoice by LSV automatically generates the corresponding payment slip and the invoice is settled. However, it may happen that the invoice is not paid, for example because the debtor has an insufficient balance on his account. However, the creditor is not informed that the payment has not been validated.

If this box is ticked, debit payments will be generated during LSV export or subsequent ISR import.

LSV data file transmission

Once you have clicked on OK in the LSV Proposal dialog box, or on Generate if you have requested manual correction of the proposals, Office Maker Business generates the file to be sent to the banks' calculation center, and automatically saves it in the location defined in the Destination folder field of the Configure LSV dialog box, in Maintenance. If this path is not specified, a standard dialog box appears, allowing you to specify the location.

This file is called “DTALSVCHF.ext” or “DTALSVEUR.ext”. The .ext extension consists of the first three characters of your LSV identification code. This name must not be modified.

All you have to do is send this file to your bank via tele-banking.

Please note: You must keep a copy of the file you send to the bank, as the latter may ask for it again if necessary.

Payment types

When the LSV processing procedure is carried out, Office Maker Business automatically creates the Payment records corresponding to the collection notes issued. These payments are of the Simple Payment (PS) type.

In the payments generated in this way, the program inserts the wording “LSV” followed by a space and the processing date in the form yymmdd (e.g. “LSV 990105”) in the Document nr field.

Handling errors and overdue payments

If the bank calculation center returns a list of errors, or if certain collection notes could not be executed (due to insufficient cover, for example), or if a dispute has been raised by the debtor, simply delete the Payments records concerned. The Payable Balance of the corresponding Invoices will then be adjusted accordingly.

If you have already exported your invoices and payments, you can no longer modify them. To correct these records, you must first use the Apply command in the Action menu to mark them as not exported. You will also need to correct the data in your accounting software. In practice, therefore, it will be much simpler to ensure that your collection notes have been properly processed before proceeding with the accounting export.

Français

Français Deutsch

Deutsch Italiano

Italiano